In this article, I share why I applied for the discover it cash back card. The Discover it credit card offers HUGE credit limits and you can get pre-approved for it with only a soft pull. So we’ll be going over the Discover it cash back credit score, Discover it cash back unboxing, Discover it credit limit increase, Discover it unboxing, Discover it sign up, and more about the discover cash back card.

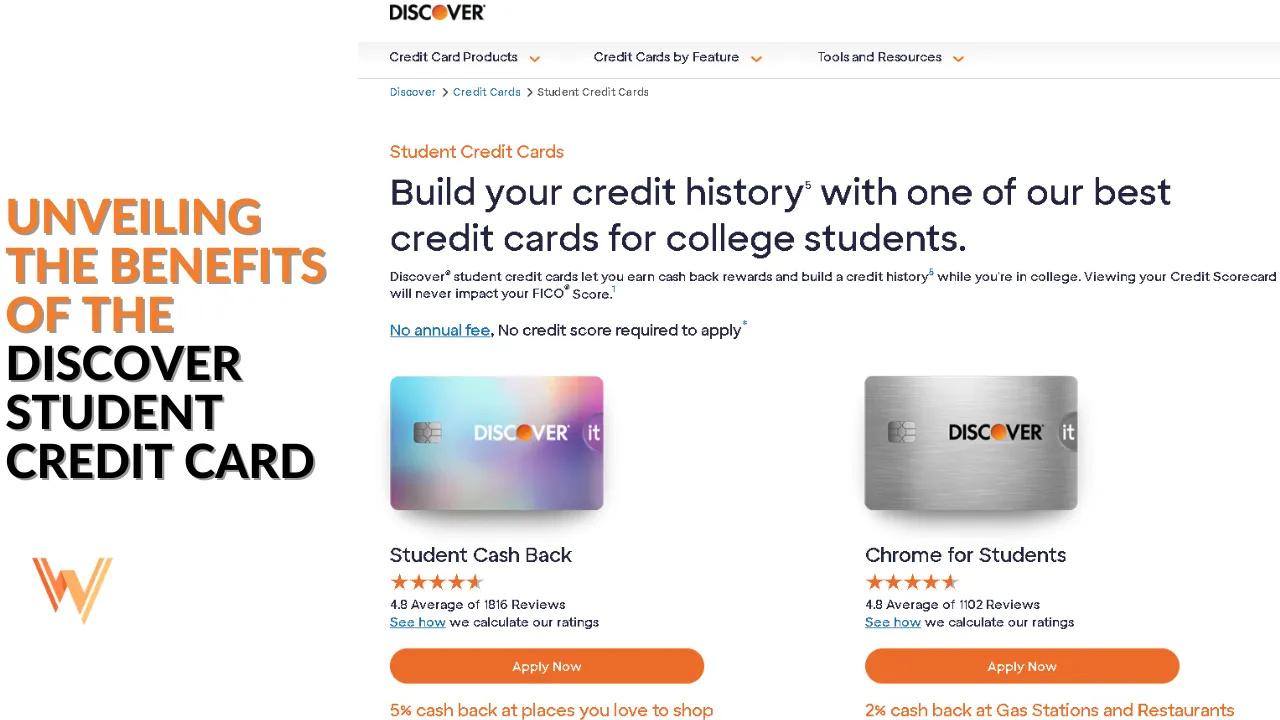

Are you a student looking for a credit card that suits your needs? Look no further! The Discover Student Credit Card is here to cater to your financial requirements while you embark on your academic journey. In this article, we’ll explore the key features and advantages of this card, helping you make an informed decision. Also Read Wells Fargo Autograph Card.

The Power of Financial Independence

Unlocking Opportunities

The Discover Student Credit Card empowers you with the ability to manage your finances independently. It provides a valuable opportunity for students to build a credit history responsibly.

No Annual Fee

One of the standout features of this credit card is that it comes with no annual fee. This means you can enjoy the benefits of having a credit card without the burden of additional costs.

Cashback Rewards

Earn While You Spend

With the Discover Student Credit Card, you can earn cashback rewards on your everyday purchases. Whether it’s groceries, dining out, or online shopping, this card has you covered.

Cashback Match

What’s even more enticing is the Cashback Match feature. At the end of your first year as a cardholder, Discover will match all the cashback rewards you’ve earned. This means double the savings!

Financial Education Tools

Building Financial Literacy

Discover is committed to helping students become financially savvy. They offer a range of tools and resources to educate you about credit management, budgeting, and financial planning.

Mobile App Convenience

Managing your credit card has never been easier. Discover’s mobile app allows you to keep track of your expenses, make payments, and monitor your cashback rewards on the go.

Security and Protection

Freeze It®

In case you misplace your card, you can easily freeze it through the mobile app to prevent unauthorized use. It’s a valuable feature that provides peace of mind.

$0 Fraud Liability

Discover takes your security seriously. You won’t be held responsible for unauthorized purchases made with your card.

What are the benefits of the Discover Student Credit Card?

Some key benefits include:

- Cashback rewards on purchases

- No annual fee

- Cashback Match, where Discover matches your cashback earnings at the end of your first year

- Access to Discover’s financial education resources

- Security features like Freeze It® and $0 fraud liability.

Frequently Asked Questions (FAQs)

Q1: What is the Discover Student Credit Card?

The Discover Student Credit Card is a credit card designed specifically for students. It offers various benefits, including cashback rewards, no annual fees, and tools to help students build good credit.

Q2: How can I apply for a Discover Student Credit Card?

You can apply for a Discover Student Credit Card online through the Discover website. The application process is straightforward and typically takes only a few minutes.

Q3. Do I need a co-signer to get this card as a student?

In most cases, students can apply for and obtain a Discover Student Credit Card without a co-signer. Discover considers various factors, including your income and credit history, when making their decision.

Q4. Can I use my Discover Student Credit Card for international purchases?

Yes, you can use your Discover Student Credit Card for international purchases. Discover is widely accepted in many countries, but it’s a good idea to check with Discover regarding any foreign transaction fees or restrictions.

Q5. How does the Cashback Match feature work?

With Cashback Match, Discover doubles the cashback rewards you’ve earned at the end of your first year as a cardholder. For example, if you earned $50 in cashback rewards during your first year, Discover will match it, giving you a total of $100 in rewards.

Q6: Are there any fees associated with the Discover Student Credit Card?

The Discover Student Credit Card typically has no annual fee, which is great for students. However, it’s essential to review the card’s terms and conditions for any other potential fees, such as late payment fees.

Q7: Can I access my Discover Student Credit Card account online?

Yes, Discover provides an online portal and a mobile app that allows you to manage your credit card account, view transactions, make payments, and track your cashback rewards conveniently.

Q8: Is there a minimum credit score required to qualify for this card?

Discover considers a range of factors when reviewing applications, so there is no specific minimum credit score requirement. However, it’s beneficial to have a fair to good credit history to increase your chances of approval.

Q9: How can I reach Discover’s customer support for any card-related inquiries?

You can contact Discover’s customer support by calling the number provided on the back of your card or by visiting their website for contact information and online support options.

Conclusion

The Discover Student Credit Card is more than just a financial tool; it’s a companion for your educational journey. With its no annual fee, cashback rewards, financial education resources, and top-notch security features, it’s a valuable asset for any student.

So, why wait? Apply for the Discover Student Credit Card today and experience the benefits for yourself. Take the first step towards financial independence and enjoy the perks of responsible credit card ownership.